TORONTO: Yes folks, it’s Halloween and everyday there are articles about the Canadian real estate market being overpriced and that the bubble is about to burst.

However for many, there are several reasons why the Canadian real estate market will not crash in the near future. Here are six such reasons.

1. Recently a minister claimed that Canada is on track to meet its goal of 401,000 permanent residents (PRs) to Canada this year. Next year’s target is 411,000 and for 2023 it is 421,000. Considering the fact that the numbers fell to 185,000 in 2020 from 341,000 in 2019 due to Covid and despite that, the property prices shot up considerably, there is a school of thought that this fact alone is enough to sustain the real estate market. All the incoming PRs will need a place to stay whether they buy or rent. If they buy, it’s a no-brainer that this will boost the property market. If they rent, that will also boost the market because investors will bid to buy properties to rent to these new immigrants. Remember also that many new immigrants come as highly trained professionals and are immediate candidates for 6 figure incomes (eg. IT professionals) and so can afford the current home prices.

2. Many hold the position that just this past week Tiff Macklem, Governor of the Bank of Canada, announced a tapering of Quantitative Easing (QE) which in short means that borrowing costs will become more expensive and mortgage rates will increase therefore leading to a drop in property prices. However, mortgages are approved subject to a stress test at a higher rate. So even if your mortgage is between 1 -2 %, the approval currently is based on whether you can afford it if the rate is 5.25%(there are exceptions, of course), so that means technically the rise in actual mortgage rates will not affect the market unless the stress test rate is raised. Also nobody sees mortgage rates going above 5% in the near future, so the spectre of rising rates will not really put downward pressure on home prices.

3. Currently the inventory of homes nationwide does not exceed 2 months which means properties (detached, semi-detached, townhomes and condos) are being picked up in less than two months from the day they are listed for sale. This means that there is more demand than supply. The current pace of new construction does not match the demand and so supply will be restricted. In the GTA where many PRs settle, the length of time a property is on the market is less than a month.

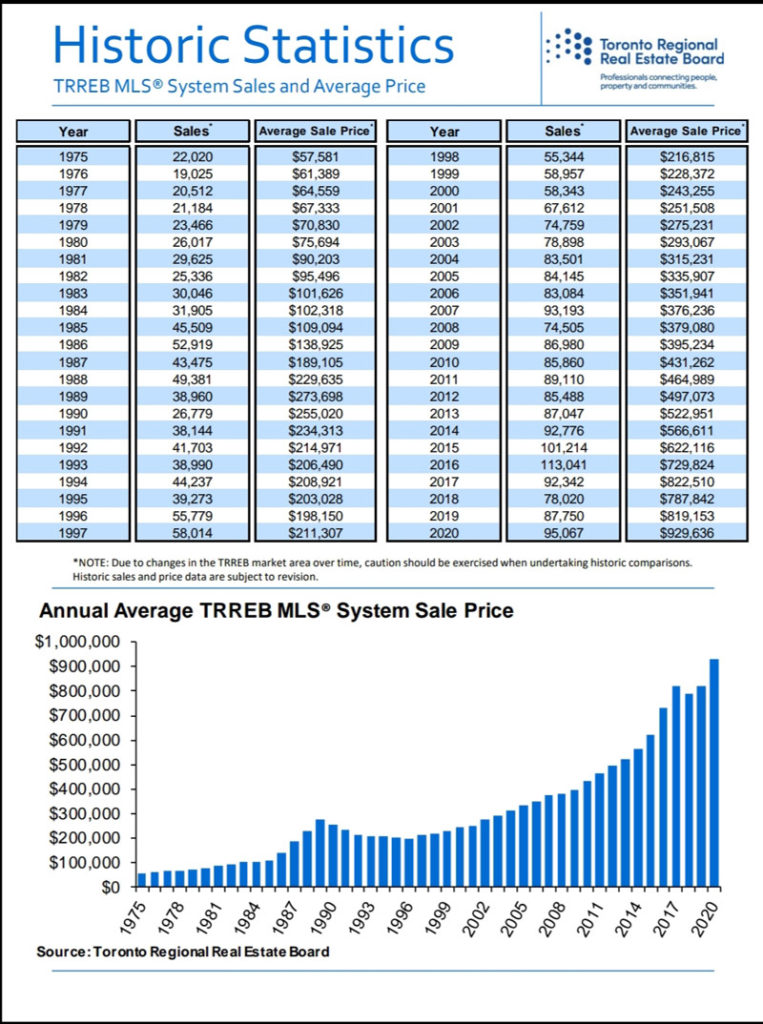

4. Since the nationwide increase in property prices are skewed because of growth in Toronto and Vancouver, let us take the case of Toronto. In this case, where just about everybody (UBS, Moody’s and most famously Capital Economics who has been predicting a crash for over a decade now) says is in a bubble and about to burst, diehards think otherwise pointing to the fact that in the last 25 years (the regular length of a mortgage) from 1995 to 2020 the average price has risen about 6.3% annually which doesn’t portend a crash at all. As a matter of fact taking into account inflation and also that way back in the 1990’s fixed mortgage rates were in the 6% range or higher, the investment in a home hardly grew 3% per annum over its mortgage life.

5. Many talk about the double digit returns of last year in the Toronto market and that this year will also end in a double digit return. That is the hot news that people use to show that the property market will take a hit. However it should be pointed out that from 2017 to 2019 the average price actually dropped and if one factors in the 13 5% increase last year and the expected increase of 13% this year, this leads again to a 6.3% increase annually over the last 4 years, equivalent to the last 25 years, so there really isn’t anything to worry about.

6. Canada is considered a safe haven governed by the rule of law thus attracting many rich overseas individuals to park their money here in real estate. No matter the surtax for owning such properties, foreigners with extra cash will still come, even if it is not a tax haven.

Finally, there is a consensus among those with their nose to the ground that going forward for at least the next couple of years, there will be no crash, but there might be a slower growth in price to keep the long time increase within 6-7 % . If there is government intervention passing acts that would stump growth like in 2017-2019, that is another thing, but otherwise things look rosy for Canada’s market.

Yes, Canada’s real estate market will continue in its lively spirits.