Full reopening of businesses will actually fuel inflation as people spend accumulated money of US$250-280 billion

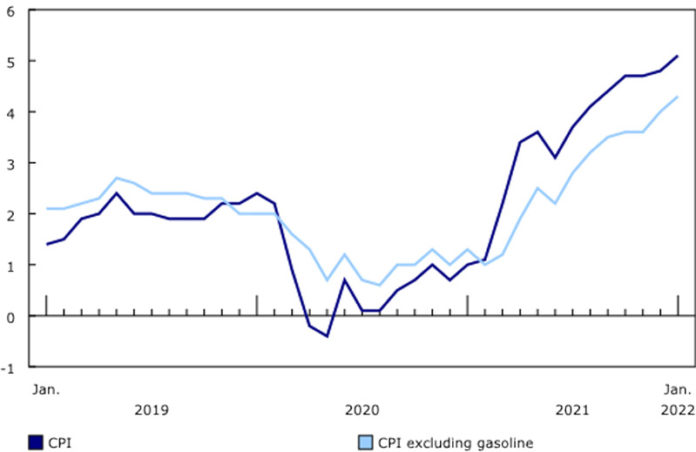

MISSISSAUGA: On March 2, the Bank of Canada (BoC) raised interest rates by 25 basis points to 0.50% from 0.25% in the first step towards curbing inflation that runs high at 5.1%.

Despite a doubling of the current rate, this new rate is quite low historically and will do nothing to dampen inflation.

Let us examine what the BoC says is contributing to the present level of inflation.

First , which is the most obvious to even the layperson, is the rise in the price of goods due to supply chain disruptions because of the COVID pandemic. During the pandemic, according to many economists, households accumulated $250-280 billion that would otherwise have been spent on services, some of it being diverted to goods that were also unavailable in sufficient quantity. This lack of supply resulted in a price increase.

Second is the rise in energy prices which even before the geopolitical crisis in Ukraine saw oil rise from the US$50/barrel range to US$80/barrel due to rising demand after the population saw Covid receding in the rear view mirror. Then Russia invasion of Ukraine has sent oil to the dizzying level of US$115. Many rightly fear that the war will again cause supply chain disruptions.

As BoC so succinctly points out, rate increases will have no effect on the above two scenarios leaving only demand driven inflation that will be affected by rate increases. However how many rate increases will be necessary to curb this?

Many economists are of the notion that these small increases will have no effect because as hospitality services, ball games, concerts, movie theatres, etc., open up to full capacity with no mask mandates in place, the cache of cash in the tune of $250 billion will be unleashed in a flash giving rise to more inflation. People will want to spend no matter the price. Even if BoC hikes the rates in April, June and July, they won’t have any effect. They will only have an effect when spending fatigue sets in, not before.

But then, when fatigue does take over, will a slowdown in demand driven inflation be enough to put a dampener on the other two factors(supply constraints and geopolitical risks) causing inflation? Perhaps when the war winds down and supplies get back to normal, then maybe we might find inflation getting anchored down, but till then it will remain unmoored.

So folks, don’t bet on inflation coming down in a hurry to the manageable level of 1-3% that the BoC is striving for.

READ NEXT: PC Party neglecting Brampton, says MPP Sara Singh